Escalating Healthcare Costs in UAE: A Call for Balanced Perspectives in iPMI

- Written by: iPMI Global

By Christian Stranzinger, with contributions from Helen Calderini at APRIL International, Christopher Knight at iPMI Global, iPMI Expert Dr Christopher Percival and Ian Youngman an independent iPMI analyst and author of the report 'The Future of International Private Medical Insurance 2024'

The ever-rising healthcare costs in the UAE have forced iPMI (international private medical insurance) providers to dramatically increase their premiums, with some making multiple adjustments over a short period. Recognizing the urgency of this issue, we decided to expand on our 2021 DOTS study on the UAE healthcare market and contextualize it with insights from our 2022 iPMI study for the GCC markets. To provide a balanced view, we also incorporated opinions from leading iPMI providers and wider market experts. Additionally, we've been exploring methodologies and strategies to navigate and potentially overcome this challenging situation.

"Escalating healthcare costs in the UAE are a major challenge for iPMI providers." Helen Calderini, APRIL International

Public versus private sector

In the UAE, healthcare is divided between government-run and private providers. The public sector operates under fixed pricing models, which makes it less susceptible to the profit-centric practices that drive up costs in the private sector. This distinction is crucial when analyzing the rising costs and iPMI premiums.

- Fixed Pricing in Public Healthcare: The government healthcare sector in the UAE adheres to set pricing standards that are less influenced by market forces. As a result, this sector doesn't contribute to the rising costs in the same way the private sector does (Government of Dubai, 2023).

- Cost Control Measures: Government hospitals often have more stringent cost control measures and are focused on accessibility and universal healthcare coverage. This is in contrast to private hospitals, where profit motives can lead to higher prices and more significant increases (Dubai Health Authority, 2022).

“Medical inflation and the cost of healthcare services is the major risk companies face when offering iPMI as part of their employee benefits program. At iPMI Global we have seen reports of premiums soaring by 35% in the latter half of 2023 in the UAE. This is unsustainable healthcare. Government and industry have a pivotal role to play in educating insureds about sustainable healthcare. Brokers should play a vital part in this by fully explaining the main factors that might affect premium cost. Options may include timely policy coverage reviews, using preventative healthcare services and addressing out of pocket expenses and policy excess.” Christopher Knight, CEO iPMI Global

A significant financial impact on iPMI

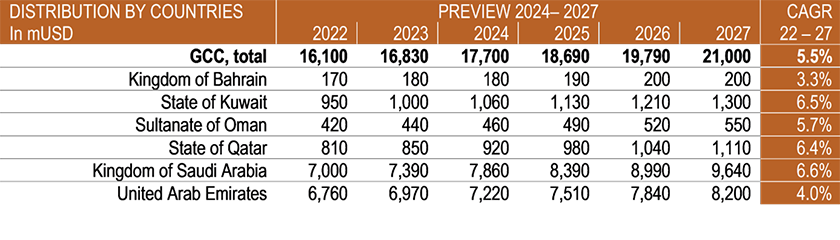

The healthcare sector in the UAE is rapidly evolving, but this growth has come at a significant cost. Our iPMI Study reveals that the healthcare market in the GCC, which includes the UAE, is expected to grow from $15.57 billion in 2021 to $21.00 billion by 2027, with the UAE alone contributing $8.2 billion by 2027 (DOTS, 2022; IMARC, 2021). These rising costs have left iPMI providers with no choice but to pass on the financial burden to policyholders through increased premiums. This trend is concerning, especially for expatriates who make up a large portion of the UAE's population and heavily depend on iPMI for their healthcare needs.

In the iPMI Picture: DOTS 2022: iPMI market distribution outlook GCC

Local versus international providers

The UAE's private healthcare sector is diverse, with local and international providers adopting different pricing strategies. While international hospitals often bring advanced medical technology and specialized care, these come at a premium. Local providers, on the other hand, may offer more competitive pricing, but with varying standards of care.

- Pricing Strategies: “International healthcare providers tend to have higher pricing due to the advanced services they offer and their brand reputation.” In contrast, local providers might keep prices lower to remain competitive but could face challenges in maintaining the same level of care (PWC, 2023).

- Impact on iPMI Premiums: The presence of high-cost international providers in the UAE inflates overall healthcare costs, contributing to the steep rise in iPMI premiums. Local providers' lower pricing “may help offset some costs but might not fully balance the premium hikes caused by international providers” (Fitch Solutions, 2023).

“The UAE is a super competitive iPMI market with a choice of local and global insurers. The problem is the fast-rising costs. Local insurers may be able to weather the storm, if they are offering iPMI and PMI, but I fear some of the global insurers may struggle. I would expect a few books of business to be sold in the future.” Ian Youngman, iPMI analyst and author of the report 'The Future of International Private Medical Insurance 2024'

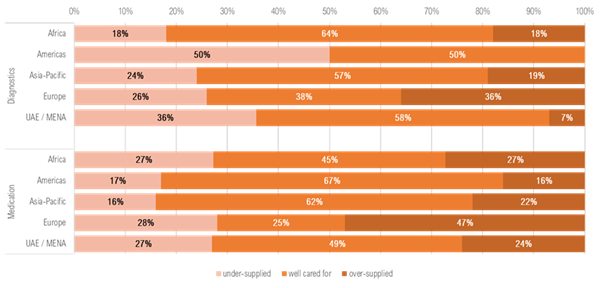

The pursuit of profit at the expense of healthcare quality

A key issue identified in our studies is the profit-driven approach adopted by some healthcare providers in the UAE. This approach often leads to an oversupply of diagnostic tests and medications, driven by financial incentives rather than patient needs. Our study noted that "the financial model in the UAE’s healthcare sector increasingly prioritizes profit margins, sometimes at the expense of patient care" (DOTS, 2021). This model contributes significantly to the escalating healthcare costs and puts additional pressure on iPMI premiums.

The market data extracted from our 2022 analysis highlights the dominance of the private sector in the UAE's health insurance market, which accounts for 65% of total Gross Written Premiums (GWP) (DOTS, 2022). With private health insurance continuing to expand, the competition among providers often leads to practices that prioritize revenue over patient outcomes, leading to unnecessary medical procedures that inflate costs and undermine care quality.

In the iPMI Picture: DOTS 2021: Perception of Diagnosis and Medication Supply (context: origin)

The importance of patient education

"Patient education is a necessity to counter the trend towards overdiagnosis." Helen Calderini, APRIL International

To address these rising costs, patient education is essential. Empowering patients to make informed decisions about their healthcare can significantly reduce the demand for unnecessary procedures.

"Educating patients to critically assess the necessity of treatments is essential in curbing the trend of overdiagnosis and overtreatment." DOTS, 2021.

By fostering a culture of informed decision-making, patients can actively participate in their healthcare journey, which could help stabilize healthcare costs and maintain more manageable iPMI premiums.

In the iPMI Picture: DOTS 2021: Patient – Insurance – Interaction

Realigning Healthcare Priorities

In addition to educating patients, there is a pressing need for healthcare providers – especially in the private sector – to realign their priorities. The primary objective of any healthcare system should be to ensure the health and well-being of the population, rather than merely achieving financial targets.

Dr Christopher Percival, iPMI expert, who has over 20 years of iPMI experience in the ME region, comments, “Whilst the health sector is a commercial business, excellent patient care should always be the vital priority. Medical inflation and high claims/age are the key factors in iPMI premium increases in the UAE. With these challenges comes opportunity. Insurers need to contain costs and conduct fraud checks on a regular basis. Companies need medical professionals to assess non-emergency situations before approving an employee to attend a doctor appointment, a clinic or hospital. Tele Medicine and online health assessments can assist with cost containment and employee efficiency.

Premiums need to be realistic and represent group size, utilisation and benefits on both mandatory and comprehensive insurance policies. Underwriters need to regularly review policy wording to ensure it meets regulatory requirements, avoids ambiguity and is in clear plain language.

Medical providers must not overuse diagnostic testing, in their duty of care and insurers should cap routine costs.”

In the governmental sector, where fixed pricing and accessibility are already prioritized, the focus should continue to be on maintaining high-quality care while controlling costs. However, private providers must shift their focus from maximizing profits to prioritizing patient outcomes to create a more balanced and effective healthcare system.

"Healthcare providers in the UAE must shift their focus from maximizing profits to prioritizing patient outcomes to create a more balanced and effective healthcare system." DOTS, 2021

This realignment is crucial not only for ethical reasons but also for the long-term sustainability of the healthcare system. A model that emphasizes patient outcomes over profit is more likely to achieve enduring success. By focusing on preventive care, evidence-based treatments, and overall patient satisfaction, healthcare providers across both sectors can create a system that benefits all stakeholders.

The search for balance: a strategic focus on sustainability for iPMI

The escalating costs of healthcare in the UAE, as reflected in rising iPMI premiums, present a significant challenge. However, this challenge also offers an opportunity for the healthcare sector – both private and governmental – to reassess its practices and adopt more sustainable approaches.

For the private sector, addressing the root causes of rising costs, such as the profit-driven approach to diagnostics and treatment, is critical. Meanwhile, the governmental sector must continue to focus on cost control and maintaining accessibility. Focusing on patient education and ethical responsibility can help create a healthcare system that is both high-quality and cost-effective.

“The future of healthcare in the UAE will hinge on the ability of providers to balance financial performance with their ethical obligation to promote public health" DOTS, 2021.

Achieving this balance is essential for ensuring the long-term sustainability of the healthcare system and the continued success of the iPMI sector.

How APRIL International tackles medical inflation with strategic cost management and healthcare networks

Helen Calderini, Head of Global Medical Network at APRIL International, highlighted the critical issue of rising medical costs at the ITIC Global 2023 conference in Barcelona, stating, "Medical inflation is not sustainable, and we cannot continue with these increasing prices. It's time for us to refocus on the situation and work together with a shared mission of providing healthcare for everyone. We're at a point where we need to rethink everything concerning healthcare policies."

In response to these challenges, APRIL International is focused on managing healthcare costs while enhancing policyholder experiences. This includes maintaining ongoing communication with members to ensure they receive appropriate care, verifying diagnoses, and advising on the best treatment locations. A team of 26 in-house medical experts supports these efforts, leveraging digital tools like the Easy Claim app and the Easy Claim Card to streamline services and control costs.

Helen Calderini also emphasized the importance of partnerships within their extensive medical network, which includes 2 million providers. “We can rely on their expertise to help us with specific cases and cost containment. We can also leverage the expertise of our telemedicine partner, Teladoc Health, to provide second or even third medical opinions when needed,” she explained.

Part of the effort to offer fair healthcare costs also involves the ability to negotiate with both current and prospective healthcare providers. "If we have a high-cost case with a particular provider, we won't hesitate to go back to the provider and discuss the costs," explains the Head of Global Medical Network at APRIL International.

Additionally, APRIL International is introducing a tiered hospital network in select markets, such as Dubai. This allows members to choose from different levels of healthcare providers based on their budget, with corresponding co-pays for premium options. “If a member opts for the Tier 2 network, their premiums will be lower… but if they wish to access Tier 1 providers, like the American Hospital in Dubai, they will know there is a 30% co-pay,” Helen Calderini noted.

Final Thoughts

The rising cost of healthcare in the UAE is a complex issue with far-reaching implications for the iPMI sector and the broader healthcare system. By addressing the factors that drive these costs, such as the profit-centric approach to diagnostics and treatment in the private sector, and by educating patients to make informed decisions, the healthcare sector can mitigate these challenges. Moreover, by realigning healthcare priorities to focus on patient outcomes rather than financial performance, both private and governmental sectors in the UAE can create a more sustainable and effective healthcare system. The ultimate goal must be to foster a healthcare environment where the health of society is paramount, ensuring that the UAE remains a leader in global healthcare.

Contributors

Helen Calderini is Head of Global Medical Network at APRIL International.

Christopher Knight is CEO of iPMI Global.

Dr. Christopher Percival is an independent iPMI expert with over 20 years of experience in the Middle East region.

Ian Youngman is an independent iPMI analyst and author of the report 'The Future of International Private Medical Insurance 2024'

Christian Stranzinger is Managing Partner at DOTS ADVISORS; and Co-Founder and Chief Inspiration Officer at XPAT-INSURANCE.COM by OEXON.

Disclaimer

This article is based on a comprehensive analysis derived from our own studies (DOTS, 2021 and 2022) as well as various external sources (IMARC, 2021; Government of Dubai, 2023; DHA, 2022; PWC, 2023; Fitch Solutions, 2022). The insights and conclusions presented herein are informed by data and opinions from industry experts, including those specializing in international private medical insurance (iPMI) and leading insurance companies, to ensure the accuracy and relevance of our views.

The perspectives included in this report reflect the current understanding of the UAE healthcare market and iPMI sector. While every effort has been made to ensure the reliability of the information, the views expressed are those of the author(s) and do not necessarily represent the official positions or policies of the organizations referenced. This article is intended for general informational purposes only and should not be construed as professional or financial advice. Readers are encouraged to seek independent professional advice tailored to their specific circumstances before making any decisions based on the content provided.